How we find the right buyers for medium-sized companies

The most important thing at the beginning

- For a successful sale of a company it is important to have the right number of interested bidders.

- Depending on the location and sector of the company to be sold, many data sources and extensive research are required.

- In most cases, both strategic buyers and financial investors as well as family offices are relevant as interested parties

- The most important criteria in selecting buyers are strategic rationale (reason to buy), financial strength and decision-making ability.

Not too many and not too few: but in any case exactly the right ones!

What are our objectives in the search for buyers?

Firstly, it is important to identify serious and solvent interested parties for the acquisition of a company. Such investors are often not actively looking for investments. Therefore, they first have to be made aware of and convinced of a concrete purchase opportunity.

Secondly, too many bidders in a sales process are not useful because this can lead to unwanted publicity among employees, customers, suppliers, etc. Each bidder needs to be managed from initial information through to negotiations and takes up resources.

Thirdly, our objective in approaching buyers is always to attract enough interested parties to be able to organise a bidding competition, without sacrificing confidentiality or efficiency in the process.

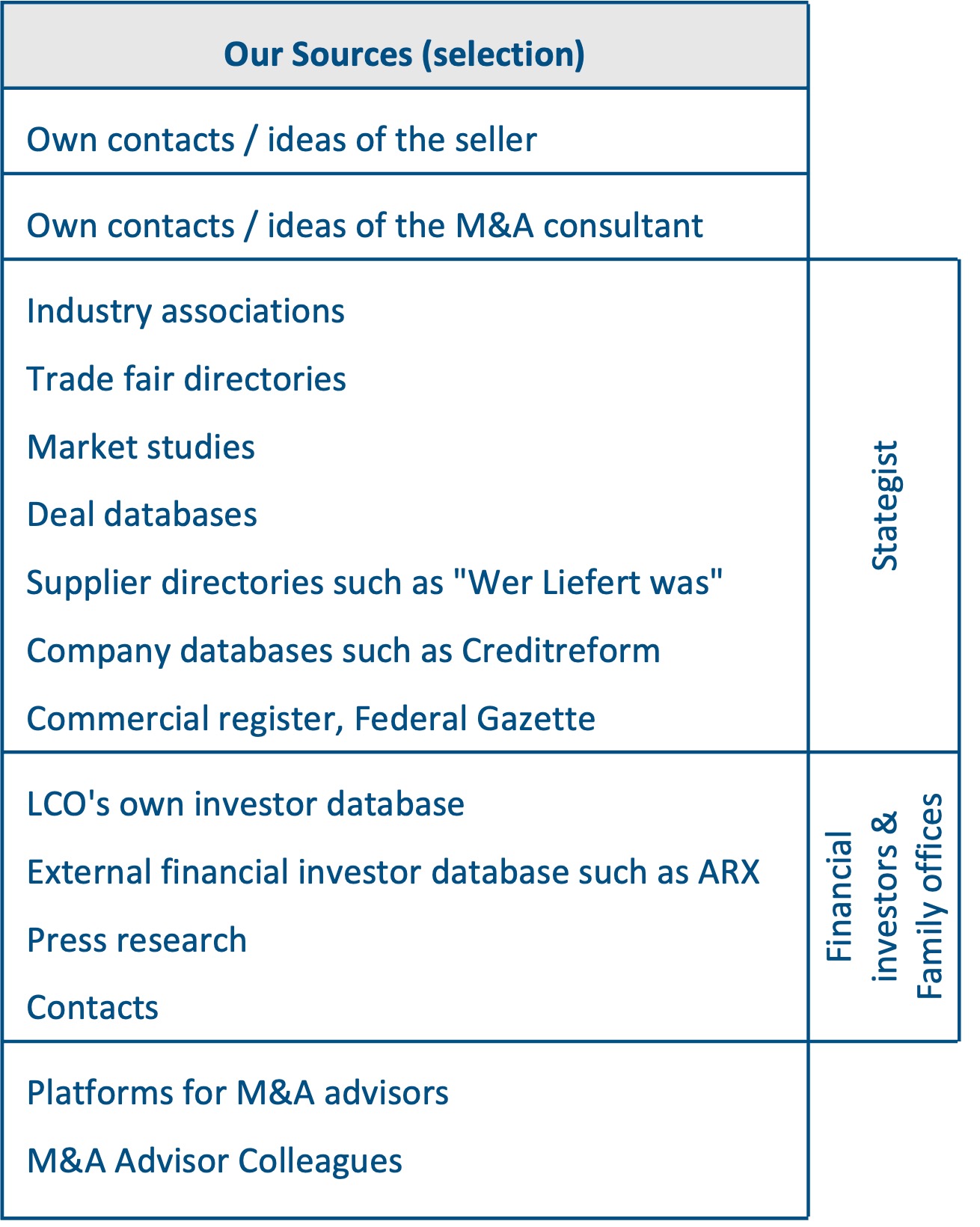

Which sources do we use for identification and qualification?

In the first step we build the so-called “long list”. Here, we first want to identify a large number of suitable prospective buyers. For this, we have a wide variety of data sources at our disposal.

Why we are not fans of company exchanges

Only in exceptional cases do we use company exchanges such as NexxtChange, DUB and similar when selling a company. Such exchanges can facilitate the search for a successor in the case of smaller company successions. The experience of many users shows that the results are very random. The strongest argument against company exchanges is that the really relevant buyers of a company are usually simply not present there, but instead unqualified, often only apparent prospective buyers of companies who do not have sufficient financial means. However, we use “professional” platforms from M&A advisor to M&A advisor, because this way anonymity can be maintained and interest in buying can be verified.

What criteria are important for assessing buyer interest?

In the next step, we select the shortlist from the longlist together with the sellers. This means that we determine the names of those potential buyers whom we then actually approach. We are guided by the following criteria:

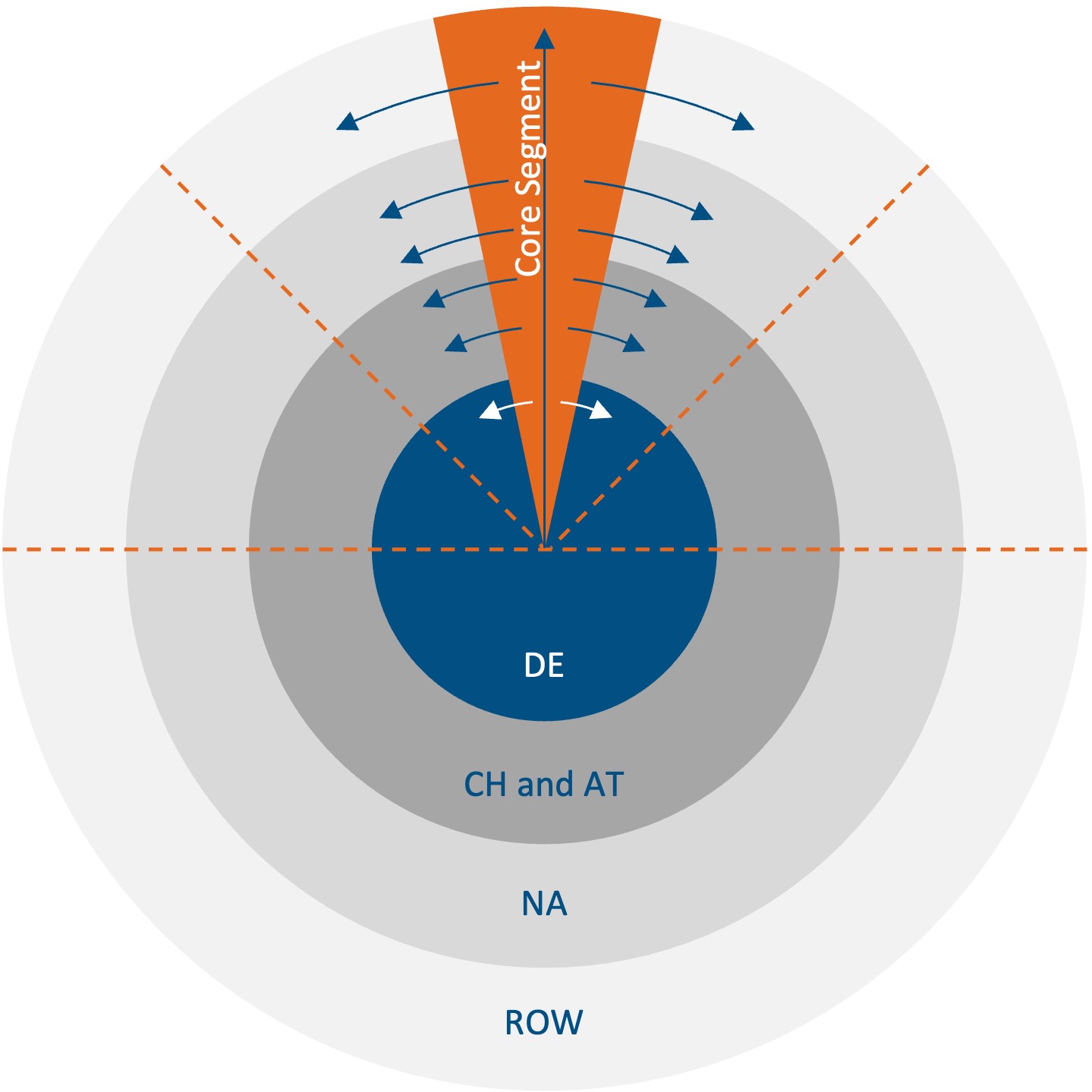

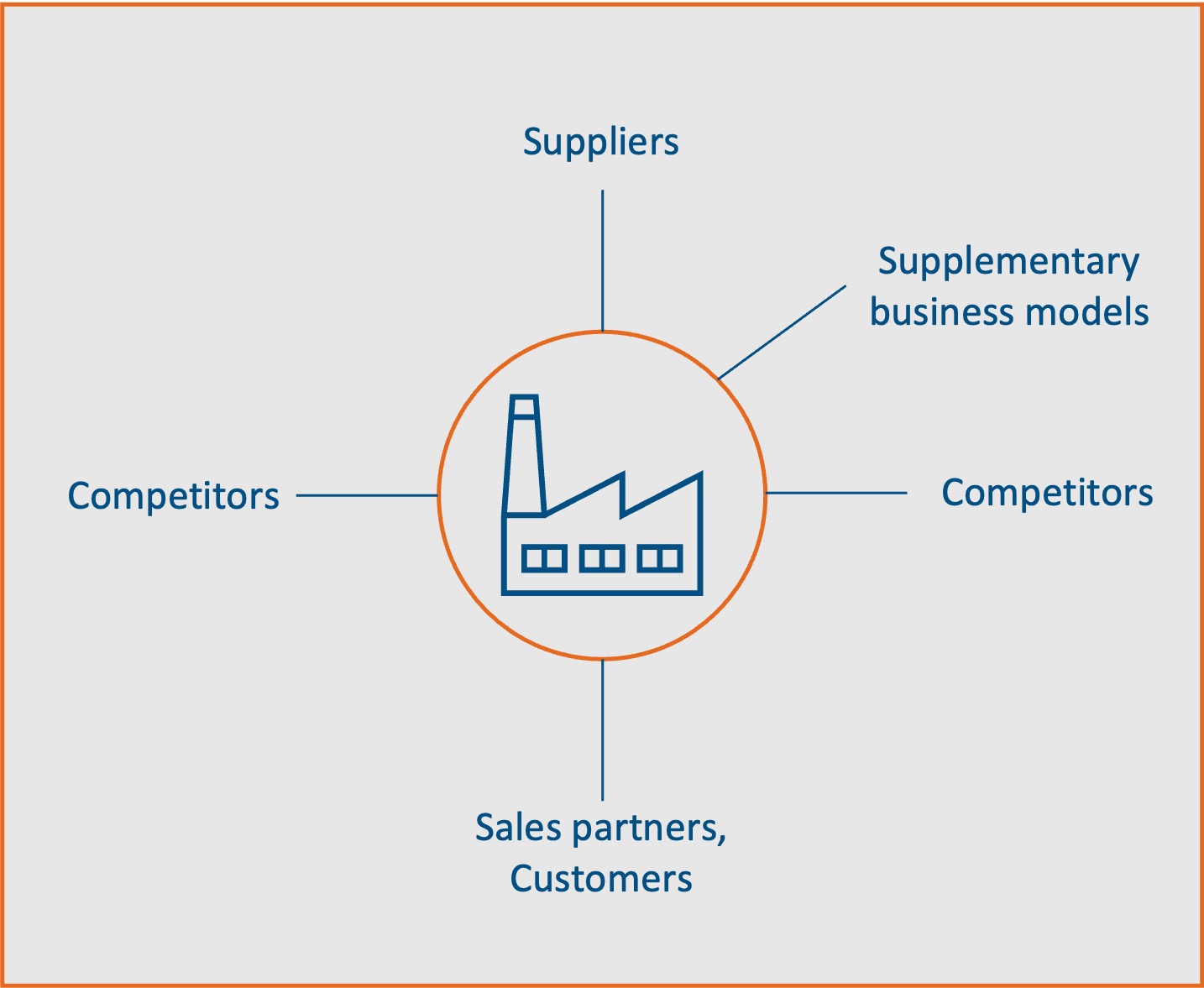

- Buying motives/ “strategic rationale”

For what reason, with what motive will a specific bidder buy? What is his “story” with this acquisition? In which area will he be able and willing to achieve added value and synergies? The first clues can be industry affiliation, company size or regional aspects. Do suppliers, competitors, customers or employees come into question? The analysis of the so-called “strategic rationale” requires both a deep understanding of the business models of the target company and the buyer as well as a sound knowledge of the market. But “out of the box” thinking, creativity and an unconventional approach can also lead to prospective buyers who were not previously in focus.

- Financial strength

Do the company size and financial ratios match the expected purchase price? We obtain and analyse information at an early stage that allows an assessment to be made.

- Decision-making power

Is the buyer likely to be open to the specific acquisition opportunity at the current time?

Which is better: strategic buyer, financial investor or family office?

- Strategic investors

Strategic investors usually run their own operating business in the same industry as the company for sale or in a related field. In most cases, strategic investors do not actively and systematically search for takeover targets, but react when they are made aware of and convinced of attractive takeover targets. Therefore, the seller should actively identify strategic investors and approach them through the right channel.

Procedure in the search for strategic investors

Strategic investors are usually interested in realising added value through synergies for their shareholders. Hence, it is particularly important for the selling company to clearly illustrate and communicate synergy potentials to the buyer.

- Financial investors

With financial investors, sellers seem to be spoilt for choice: more than 1,000 financial investors in Germany state that they are looking for SME takeover targets. According to the press, these investors had more than around 24 billion euros available for investment purchases in 2021. The investors even complain of excessive “investment pressure”. Almost every entrepreneur regularly receives form letters from investors who are supposedly willing to buy. So, rosy times for sellers?

The less good news, however, is: No, by no means do all SMEs find a suitable buyer among the financial investors. Why is that?

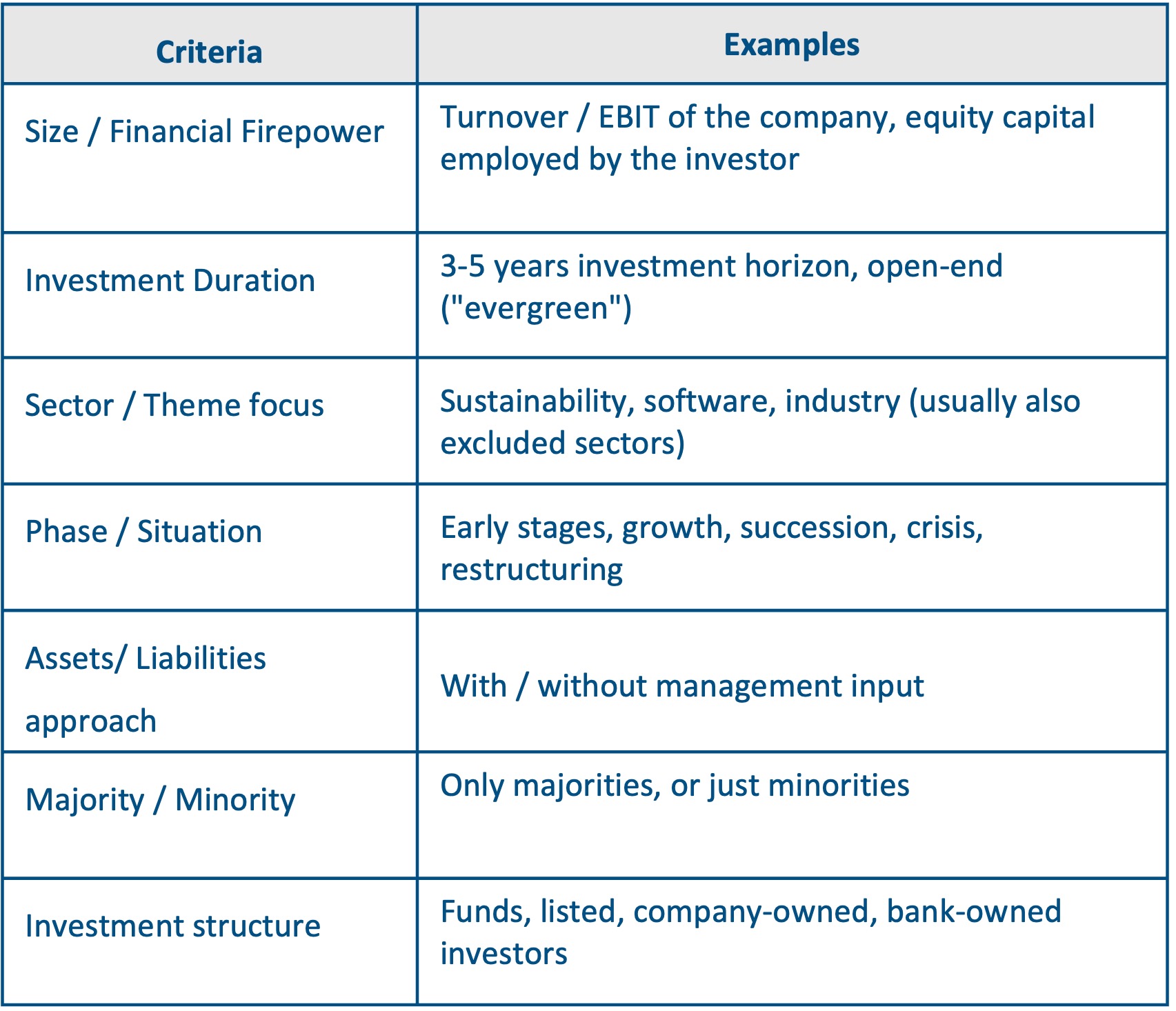

The criteria of financial investors are often very narrow and restrictive. In addition, the desired profiles are often extremely similar. Those who do not fit into the desired profiles are therefore very quickly sorted out.

On the bright side, if you approach the right investors, meet their criteria and organise the sales process correctly, you can expect a (very) attractive sales price and a fast and secure sales transaction.

We ourselves have therefore built up our own investor database. We keep detailed records of which investors want to invest, in which size, in which sector, in which company situation, with which time horizon.

We can thus efficiently and effectively filter out suitable investors.

Different types of financial investors

- High net worth individuals/family offices

Family offices have become increasingly important on the markets for corporate investments. In recent years, many wealthy entrepreneurs have set up their own organisations for the acquisition of shareholdings (“family offices”) and are now active in the market. Such investors are often reticent in their communication and external appearance and are therefore not easy to find. They differ greatly in the degree of professionalism and often (not always) invest in sectors that show a kinship to the investor’s original entrepreneurial activity. Other relevant investment criteria can be personal relationships or regional proximity to the target company. The advantage of family offices is the often pronounced entrepreneurial experience and attitude as well as the long-term perspective of such investors. However, this does not always lead to the highest purchase price offers.

TIP: Do not talk to potential buyers one after the other, but simultaneously in a structured process. This optimises the purchase price and negotiating power.

If you need advice, please contact us confidentially and without obligation. We will find the right potential buyers for your company!

Your contact person

Markus Loy

Managing Director

T: +49 211 20 49 6000M: +49 151 40010026E: loy@loy-cf.deBilker Straße 11

40213 Düsseldorf